All data shared was pulled directly from the Shovels platform. Start a free trial here.

Virginia continues to reinforce its status as the epicenter of data center development in the U.S. Between July 2024 and July 2025, the state issued an impressive 1,239 permits explicitly linked to data centers—an astonishing 80.4% of all such permits nationwide. The uncontrolled expansion of data centers in Northern Virginia is creating significant conflict, as evidenced by new housing developments now encircled by these facilities. Bloomberg reports this situation is intensifying calls for stricter regulation. This robust activity not only underscores Virginia’s central role in supporting the digital economy but also generated significant local revenue, totaling over $1.6 million in permit fees associated with 57 unique contractors working across 140 different locations.

In this post, we’ll summarize our findings, explore proxy search terms to uncover data center permits, and share raw data pulled directly from the Shovels platform.

Key Findings

- Loudoun County accounts for 89.67% of Virginia's data center permits

- Sterling leads all cities with 442 permits (35.67%)

- $1,599,186.68 in total permit fees collected

- 890 permits (71.8%) currently in review or active status

- 57 unique contractors involved in data center projects

- 140 unique addresses with data center development

Loudoun County: The Heart of Data Center Alley

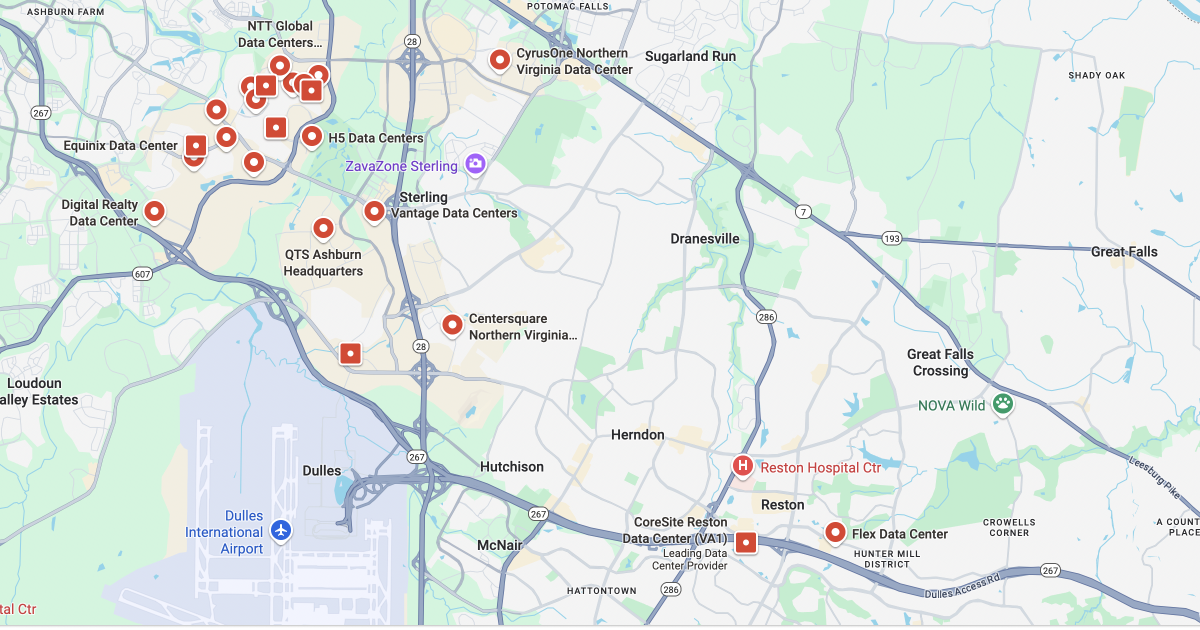

Data centers in Loudon County, VA. Source: Google Maps

Data centers in Loudon County, VA. Source: Google MapsThe data reveals Loudoun County as the undisputed leader, accounting for nearly 90% of all permits issued in Virginia. Sterling emerged as the leading city, with 442 permits (35.67%), emphasizing its critical role in the sector. Leesburg and Aldie followed closely, reflecting growing corridors of activity.

| County | Permits | % of Total | Cities | Locations | Contractors |

|---|---|---|---|---|---|

| Loudoun | 981 | 89.67% | 4 | 79 | 35 |

| Fairfax | 59 | 5.39% | 9 | 28 | 3 |

| Manassas | 30 | 2.74% | 1 | 15 | 4 |

| Prince William | 16 | 1.46% | 2 | 6 | 4 |

| Others | 8 | 0.74% | 7 | 8 | 3 |

The dominance of Loudoun County is driven by its established infrastructure, proximity to major internet exchange points, robust power availability, and supportive local policies.

The Anatomy of Virginia’s Data Center Boom

The 1,239 permits mentioned above specifically mention "data center" while there are other permits that we can confidently deduce are infrastructure upgrades related to data centers.

Case in point, permits for infrastructure upgrades accounted for nearly 50% of all permits, reflecting the industry's maturity and increasing demand for electrical and cooling capacities. Specifically, permits for electrical infrastructure alone comprised over 27% of all permits, underscoring critical power needs.

Top permit categories included:

- Electrical (commercial alterations): 132 permits

- New electrical infrastructure: 116 permits

- Mechanical upgrades: 76 permits

Contractors and Mega-Projects

Several major contractors lead the development, including Dynalectric Co., SES Mid Atlantic LLC, and HITT Contracting Inc., showcasing a specialized ecosystem geared towards high-capacity electrical and mechanical infrastructure.

Notable mega-project sites:

- Celtic Park Drive, Leesburg: 286 permits

- Light Speed Plaza, Sterling: 246 permits

- Reeds Farm Lane, Aldie: 96 permits

Monitoring the Market’s Pulse

While the market remains strong, recent data indicates a sharp decline in permit activity from June to July 2025, a trend warranting close observation for potential market saturation or seasonal factors. Still, with over 890 permits currently under review, the future pipeline remains robust.

Implications for Stakeholders

Virginia’s data center landscape continues to flourish, driven by concentrated expertise, infrastructure investments, and a favorable regulatory environment. As the market matures, understanding hidden trends and diversifying strategically will be essential for sustained leadership in this critical industry.

For Developers:

- Focus on infrastructure efficiency in existing facilities

- Consider secondary markets within Virginia

- Plan for phased development approaches

For Contractors:

- Specialize in critical infrastructure (electrical, mechanical)

- Build relationships with major developers

- Prepare for continued high activity through 2025

For Policymakers:

- Monitor infrastructure capacity constraints

- Consider incentives for geographic distribution

- Ensure power grid can support continued growth

For Investors:

- Strong pipeline supports continued investment

- Focus on companies with electrical/mechanical expertise

- Monitor emerging locations (Aldie, Prince William County)

City-Level Analysis

The top data center cities in Virginia:

1. Sterling (442 permits, 35.67%)

- 41 unique locations

- 20 contractors active

- Major hub for data center development

2. Leesburg (348 permits, 28.09%)

- 10 unique locations (indicating larger projects)

- 12 contractors

- Home to several mega-projects

3. Aldie (114 permits, 9.20%)

- 5 locations

- 6 contractors

- Emerging data center corridor

4. Ashburn (77 permits, 6.21%)

- 23 locations

- 12 contractors

- Historic center of Data Center Alley

Temporal Trends and Market Dynamics

Monthly Permit Activity

The data reveals interesting patterns:

Peak Activity Period (Oct 2024 - May 2025):

- October 2024: 188 permits (highest single month)

- December 2024: 208 permits

- April 2025: 184 permits

- May 2025: 167 permits

Notable Decline (June-July 2025):

- June 2025: 15 permits (91% decrease from May)

- July 2025: 1 permit (partial month data)

This sharp decline warrants monitoring as it could indicate:

- Seasonal patterns in construction planning

- Market saturation in certain areas

- Economic or regulatory changes

- Data collection lag

Permit Status Distribution

Current status shows active development pipeline:

- In Review: 890 permits (71.8%)

- Active: 135 permits (10.9%)

- Final: 41 permits (3.3%)

- Unknown/Other: 173 permits (14.0%)

The high percentage of permits in review suggests continued strong demand and future construction activity.

Project Types and Infrastructure Focus

Work Category Breakdown

Analysis of permit types reveals the nature of data center development:

1. Other Infrastructure (49.96%)

- Electrical, mechanical, plumbing systems

- Critical for data center operations

2. New Construction (22.52%)

- 279 permits for ground-up builds

- Significant capacity expansion

3.Alterations/Modifications (22.44%)

- Upgrades to existing facilities

- Modernization efforts

4. Tenant Fit-Outs (5.08%)

- Customization for specific clients

Top Permit Types

The most common permit types reflect infrastructure priorities:

- Electrical (commercial) - alteration: 132 permits (10.65%)

- Electrical (commercial): 116 permits (9.36%)

- Electrical (commercial) - new construction: 91 permits (7.34%)

- Mechanical (commercial): 76 permits (6.13%)

- Building commercial - new construction: 74 permits (5.97%)

The dominance of electrical permits (339 total, 27.36%) underscores the critical power infrastructure needs of data centers.

Major Development Sites

Mega-Projects by Location

Several addresses show concentrated development activity:

1. Celtic Park Dr, Leesburg - 286 permits

- 11 different work types

- Active from July 2024 to March 2025

- Likely a major campus development

2. Light Speed Plz, Sterling - 246 permits

- 8 work types

- Single contractor (indicating unified project)

- Continuous activity through May 2025

3. Reeds Farm Ln, Aldie - 96 permits

- Multi-phase development (18+ phases mentioned)

- 4 different contractors

- Three-story data center complex

4. Broderick Dr, Sterling - 91 permits

- IAD 291 data center project

- Multiple tenant fit-out phases

- Active through June 2025

Contractor Ecosystem

Leading Contractors

The top contractors demonstrate specialization in data center construction:

1. Dynalectric Co. (86 permits)

- Electrical specialty contractor

- Active in 4 cities

2. SES Mid Atlantic LLC (58 permits)

- 4 unique addresses

- 3 cities served

3. HITT Contracting Inc. (44 permits)

- General contractor

4. The Severn Group Inc. (35 permits)

- Focused on single location (specialized project)

Notable patterns:

- Electrical contractors dominate (Dynalectric, Rosendin)

- Mix of local and national firms

- High concentration on few major projects

Financial Impact

Permit Fee Analysis

- Total Fees Collected: $1,599,186.68

- Average Fee (where recorded): $3,988.00

- Permits with Fee Data: 247 (19.9%)

The limited fee data suggests many jurisdictions don't consistently record fees or have varying fee structures. The average fee of nearly $4,000 indicates significant revenue generation for local governments.

Industry Insights and Implications

1. Infrastructure Over New Builds

Nearly 50% of permits are for infrastructure improvements rather than new construction, indicating:

- Maturation of existing facilities

- Technology refresh cycles

- Increasing power and cooling demands

2. Geographic Concentration Benefits and Risks

Loudoun County's 89.67% concentration presents:

- Benefits: Established ecosystem, skilled workforce, infrastructure

- Risks: Over-concentration, resource constraints, single point of failure

3. Phased Development Approach

Major projects showing 10+ phases indicate:

- Risk mitigation strategies

- Demand-driven expansion

- Capital efficiency

4. Contractor Specialization

The dominance of electrical contractors reflects:

- Critical nature of power infrastructure

- Increasing power densities

- Need for specialized expertise

Market Outlook and Recommendations

Short-Term Considerations

- Monitor June-July Decline: The 91% drop in permits requires investigation

- Pipeline Strength: 890 permits in review suggest 6-12 months of activity

- Infrastructure Focus: Continued emphasis on electrical/mechanical upgrades

Long-Term Strategic Implications

- Geographic Diversification: Consider opportunities outside Loudoun County

- Contractor Relationships: Limited contractor pool creates both opportunities and risks

- Technology Evolution: Infrastructure modifications suggest adapting to new technologies

Data Center Proxy Indicators: Identifying Hidden Data Center Permits in Virginia

Interestingly, explicit data center permits represent only part of the story. Analysis of permit descriptions revealed hidden indicators—like high-amperage electrical systems and specialized cooling references—that point to additional, uncounted data center activity. At Beaumeade Circle in Ashburn, only 8 permits explicitly mention "data center," but 75 additional permits show clear data center indicators - that's 90% hidden activity. Similar patterns appear at other locations.

This suggests the true scale of data center construction in Virginia might be 15-20% higher than official counts. Many data center permits don't explicitly mention "data center" in their descriptions. Through analysis of permit patterns in known data center locations, we've identified key indicators that strongly suggest data center construction or operations. These "proxy indicators" could reveal hundreds or thousands of additional data center-related permits.

Primary Proxy Indicators

1. High-Amperage Electrical Infrastructure

Indicator Terms:

- "4000A service" (4000 amp) - Standard for data center power

- "3000A service" or "3000A switchgear"

- "2500kw" or "2750kw generator"

- Multiple electrical "lineups" (e.g., "lineup a1", "lineup b1")

Example Permits Found:

- Efficiency Dr, Sterling: Multiple "4000a service and gen" permits

- Beaumeade Cir, Ashburn: 7+ permits for "Phase 4 lineup [X] 4000a service"

2. Data Hall References

Indicator Terms:

- "data hall" or "data halls"

- "data hall fit-out"

- "data hall fan wall units"

Why It Matters: "Data hall" is industry-specific terminology almost exclusively used in data centers.

Example Permits Found:

- Multiple "Low voltage for hvac controls for interior alteration - data halls" at Beaumeade Cir

- "Level 1 data hall fit-out" at Relocation Dr, Sterling

3. Critical Power Infrastructure

Indicator Terms:

- "UPS" (Uninterruptible Power Supply)

- "1000kw ups" or similar

- "Medium voltage" or "34.5kv"

- "switchgear" with high amperage

- "backup power" or "emergency power" at commercial scale

Example Found:

- "Phase 4 lineup r1 (1) cod switchboards 3000a-480v (2) mod panels 400a-480v (2) 1000kw ups"

4. Specialized Cooling Systems

Indicator Terms:

- "CRAH" (Computer Room Air Handler)

- "chiller" in commercial contexts with high power

- "cooling tower" with electrical infrastructure

- "fan wall units" in data halls

Why It Matters: These are specialized HVAC systems designed for high-density computing environments.

5. Fire Suppression Systems

Indicator Terms:

- "VESDA" (Very Early Smoke Detection Apparatus)

- "double interlock pre-action valves"

- "pre-action sprinkler" systems

- Fire systems specifically for "data halls"

Example Found:

- "Expansion of the existing vesda (assd) network" at Relocation Dr

6. Phased Development Patterns

Indicator Terms:

- "Phase [number]" with high-power electrical

- Multiple permits for same address with sequential phases

- "lineup" designations (a1, b1, c1, etc.)

Pattern Example: Beaumeade Cir shows Phase 4 with lineups a1 through r1, indicating systematic buildout.

7. Project Naming Conventions

Indicator Terms:

- "IAD" prefix (Internet Ashburn Data center designation)

- "POD" references (Point of Delivery)

- "PC" or "PowerCenter" designations

- Alphanumeric building codes (e.g., "usb 2.4b", "ara3a-fr1")

Examples Found:

- "Iad 055 pod 13 wmw electrical upgrades"

- "Pc4 3000a service: powercenter 4-1d 2233"

Geographic Patterns

High-Probability Streets for Hidden Data Centers:

Based on the analysis, these streets show significant "hidden" data center activity:

- Efficiency Dr, Sterling - 17 implicit indicators vs 4 explicit

- Beaumeade Cir, Ashburn - 75 implicit vs 8 explicit

- Relocation Dr, Sterling - 16 implicit vs 1 explicit

Recommended Search Strategy

There are high and medium-confidence proxy search indicators we identified in analyzing the data. To uncover potential hidden data center projects, we recommend searching for permits containing:

- 4000a

- 3000a

- Data hall

- CRAH

- Vesda

- 2500kw

- Switchgear

- Ups

- Medium voltage

- lineup

In addition to these additional search terms, consider location + infrastructure:

- Commercial permits in Loudoun County with fees > $5,000

- Multiple electrical permits at same address

- Permits mentioning "phase" with electrical work

- Streets with known data center presence

Validation Approach

To confirm these are data center projects:

- Cross-reference addresses with known data center locations

- Look for permit clusters - multiple high-power permits at same address

- Check contractor patterns - same contractors working on confirmed data centers

- Analyze permit sequences - phased development over time

Estimated Hidden Volume

Based on the sample analysis:

- Explicit mentions: 681 permits at these 7 addresses

- Implicit indicators: 120 additional permits

- Hidden ratio: ~15% of data center activity may be "hidden"

Extrapolating to all of Virginia:

- If 1,239 permits explicitly mention "data center"

- An additional 185-250 permits may be data center-related but hidden

- Total real data center permit activity: ~1,425-1,490 permits

Business Intelligence Value

This analysis enables:

- More accurate market sizing - Understanding true scale of data center development

- Early identification of new data center projects before public announcement

- Competitive intelligence - Tracking competitor expansion through proxy indicators

- Site selection - Identifying areas with data center-ready infrastructure

- Contractor analysis - Finding specialized contractors through permit patterns

Recommendations

- Expand search queries to include these proxy indicators

- Create alert systems for high-confidence indicator combinations

- Map infrastructure patterns to predict future data center corridors

- Track permit sequences at addresses showing these indicators

- Monitor contractor activity on permits with these characteristics

The true scale of data center development in Virginia is significantly larger than what appears in explicit "data center" permit searches. By using these proxy indicators, analysts can uncover 15-20% more data center activity and gain earlier insights into market developments. The concentration of these hidden permits in known data center areas validates these indicators as reliable proxies for data center construction.

Start digging our data with a free online Shovels account, or contact us today to get started.