In an engaging discussion on the latest trends in PropTech investment, Ryan Buckley and Fernando Pizarro dissected a recent article by Brad Hargreaves, offering a timely examination of the state of PropTech investing. The conversation, rich with personal insights and industry analysis, ventured into the nuances of fundraising, from the early stages of securing capital to the strategic moves shaping companies' futures in the PropTech landscape.

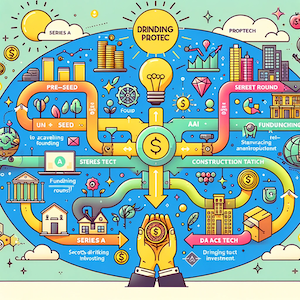

Buckley shared his journey with Shovels, detailing their fundraising progress and strategic decision-making to manage dilution and value for early and potential investors. He elaborated on the distinctions between pre-seed, seed, and Series A funding rounds, shedding light on the evolving definitions and expectations at each stage. This provided a practical framework for understanding how startups navigate the complex terrain of investment, balancing growth, valuation, and investor relationships.

Fernando and Ryan also explored the broader investment climate, discussing the impact of macroeconomic factors on fundraising and the sectors within PropTech drawing investor interest. They touched on the significance of AI and data management in attracting investment, highlighting the symbiotic relationship between data and AI in creating a competitive edge.

The dialogue further delved into construction tech's rising appeal, emphasizing the industry's delayed but accelerating adoption of technology and the potential for significant efficiency gains. Buckley and Pizarro conversed about the strategic pivot from point solutions to broader platform visions, illustrating the journey from niche offerings to comprehensive solutions addressing wider market needs.